(Solution) How to Pay for Zoom in Nigeria

This page has a solution for Nigerians who have struggled to upgrade their plan on Zoom. The problem arises when trying to use bank cards without any success. The next…

Read more »How to Pay for Duolingo English Test in Nigeria

Duolingo English test is a great alternative for international students who do not want to take the IELTS or TOEFL exams. However, many Nigerian students are confused about how to…

Read more »

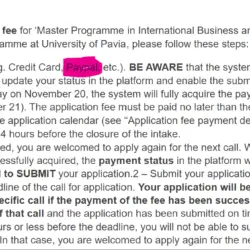

How to Pay Application Fee in Nigeria

This post is targeted to solve the problem of paying for application for Nigerian students looking forward to study abroad. The naira debit card can’t process the payment no thanks…

Read more »

What is forex spread, and how does it work?

The foreign exchange market is the largest and most prevalent financial market globally and is a platform where currencies are traded. This vibrant market operates all day, five days a…

Read more »

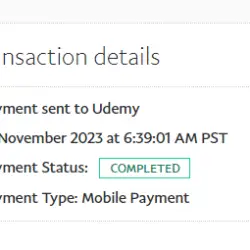

How to Pay for Udemy Courses in Nigeria (ATM cards don’t work)

This time we’ve turned our attention to solving a painful problem many Nigerians face. As you’ve found out Nigerian debit cards don’t work on many of these platforms. Many of…

Read more »How to Pay for Alison Certificate in Nigeria

A lot of Nigerians have been left frustrated trying to pay for Alison certificate. If you’re one of those people then you’re in luck as this post brings you a…

Read more »

Top 6 Sites to Buy Instagram Reels Views [100% Safe and Real]

Instagram is a fast-paced social media where you need to stand out from the crowd to grab your audience’s attention. The platform has many engaging features. One of its most…

Read more »

The Ultimate Guide to Getting More TikTok Followers

Welcome to AskNaij. In this article, we turn our focus on how to get more followers (also faster) on TikTok. Becoming a social media influencer is in high demand nowadays….

Read more »Why Are Apps Greyed Out On iPhone? – Find Out!

Have you ever been frustrated when trying to use an app on your iPhone, only to find it greyed out and unusable? If so, you’re not alone. Many iPhone users…

Read more »Solution To Android Auto-Answer Incoming Calls Not Working

Is your Android auto-answer not working? Are you tired of manually answering every call? Then this article is for you! Read on to find out how to quickly and easily…

Read more »

Is 150mps Good For Gaming? – Find Out!

Are you a serious gamer looking for the best internet speeds for your gaming needs? If so, you may have heard about plans offering up to 150 Mbps download speeds….

Read more »Solution To Can’t Hear Phone Calls On Bluetooth In Car

Are you fed up with not being able to hear phone calls clearly when using a Bluetooth connection in your car? Do you struggle to hear the person on the…

Read more »