TIN stands for Tax Identification Number. It is a unique number which is given to any individual, incorporated company or registered business for the purpose of paying taxes, proper identification and verification.

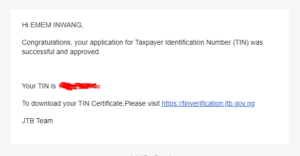

Once you have registered for this number as a taxpayer, it would be generated by the Federal Inland Revenue Service (FIRS) in conjunction with the Joint Tax Board. Note instructively that you cannot apply for a tax clearance without a TIN as the latter would be used to get the former. This article will show you how to get a TIN and also how to check it using your phone and other details.

Why do you Need the TIN Number?

You need the TIN to:

- To apply for a government loan.

- To open a business account

- To get an export, import or trade license.

- To register your vehicle.

- To get tax clearance, incentive or allowance.

In my case, I needed to submit my TIN on Monnify when I was trying to link to my VTU website.

How to Get TIN Number in Nigeria

The TIN can be gotten physically or online. As an individual, follow the exact process I got mine:

I was tipped by a friend to get to my bank and get my BVN printout before heading to the State Internal Revenue Service (SIRS) here in Uyo, Akwa-Ibom State. When I got there I was asked to present the BVN printout which I did. A form on the screen was filled which included my email address and phone number. It didn’t take up to 20 minutes before I received a mail with my TIN.

That was it.

If you represent a company, you can get your TIN online by following the instructions below:

Visit https://tin.jtb.gov.ng/TinRequestExternal and fill out the TIN application form. Enter the following:

- Business registration number

- Business Name Registration Certificate

- Business name, address, e-mail, Phone number

- Business Sector

- Date of Commencement

- The company’s business address

- Certificate of Incorporation.

- Copy of memorandum and articles of association

- Location and Date of Incorporation

- Directors Details

- Active email address

Submit the form and wait for a response via email notifying you if the issuance of the TIN

How to Check your TIN Number on the Phone

To check your TIN on your phone, follow the simple instructions:

- Visit the TIN portal on the Joint Tax Board site.

- Select the date of your company’s incorporation or your date of birth.

- Select your preferred criteria whether BVN, NIN or a registered number.

- Enter the digits as required by your preferred search criteria. For instance, BVN, enter your BVN.

- Click on the ReCaptcha box to confirm you are not a robot.

- Click on the Search option and search for your TIN. You would see your TIN if you successfully registered.

Final Thoughts

As a Nigerian citizen, it is your duty to pay taxes to the government. This is why the FIRS was created: to cover the process of tax collection. However, before you can successfully pay your tax, you would need to get your TIN. Fortunately, we have made the process easier for you by highlighting the ways you can get your TIN whether as an individual or company and also how you can check it conveniently on your phone.

A lover of tech.